So on the weekend I was lucky enough (might not be as exclusive as it once was but I felt special) to be invited to sign up to get my hands on a Monzo Account/Card/App/Thing so I though I could give it a try. After a chat with a friend/colleague last week about his use of the account while on his holiday, with its ability to top up (as its pay-as-you-go at the mo, ZERO fees abroad, block the card, instant transfers, change the pin, turn magnetic strip on for shops that do not have chip and pin (really?) and a detailed transaction info history to name a few. I already use the online app with my current bank account and I a big fan, so Monzo has quite a tough act to follow but I love when fresh competition rock up and make the more traditional establishments up their game or realise how good they’ve has it for far too long.

Monzo Bank Limited is a company registered in England and Wales (No. 09446231) it is authorised by the Prudential Regulation Authority (PRA) and regulated by the Financial Conduct Authority and the PRA. listed under coming soon are “Sort Code and Account numbers” and “Standing orders” to name a few, the usual current account functions but this is BETA, so thats ok, BETA is cool right. The only one coming soon which I think needs to be sorted ASAP (and probably in BOLD on their site and App) is FSCS protection, or lack of! what does this mean seeing as they are a registered in the UK, well in a nutshell, if you load your card up with money and for some horrible reason Monzo close down, the money is potentially gone. My advise, after reading this is, keep top ups small and let them for their magic getting FSCS protection.

So after receiving the invite, I download the App, popped in the email address I was referred on, it then asked for the usual info like name, address etc and then the fun part, you have to use the app to submit an image of your passport or driving licence AND a video of your face say something like “I would like a Monzo card” not a oscar winning role but close 😉 . All good fun and the app notified me about 5 minutes later that verification had been successful and I needed to top up £100 which if fine as I will use it in my test lab…..a.k.a life 🙂 A lot painless than what I recently witnessed when a family member tried to open a bank account froma high street provider.

Some of the claims from Monzo site are

“The bank of the future – Built for your smartphone, this is banking like never before. One that updates your balance instantly, sends intelligent notifications, and is actually easy to use.We’re building the best current account on the planet and we want you on board.”

“Fast and friendly support – Still having to wait on hold for hours to get anything sorted with your bank? Monzo provides world-class support through in-app chat, with an average response time of under ten minutes.”

“We started Monzo because we think that banking should be better – In a world where you can use an app on your phone to order food or a taxi, it’s ridiculous that your bank still takes days to update your balance when you make a card payment.”

While the Card was being sent the app only give you an cool animation of a card running its way to you with an ETA and a button to say when the card arrives. ETA was Wednesday and my card arrived a day early, they get a thumbs up from me for customer service from day erm -1 🙂 … NICE!

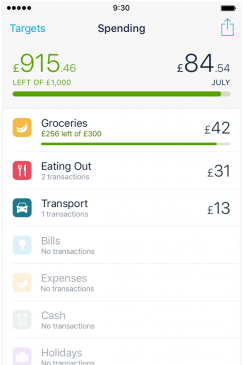

Clicking the “card arrived” button you enter the 9 digit code and you when have access to the app fully. The Apps looking bare other than the balance but I’ll soon change that 😀 I borrowed a test image from Monzo website of an App showing an account with use.

So what am I hoping for from this card and what I will test (in fact I’m going to make it a bit of a game so I actually get around to testing….in my best 80’s computer digitised novice “shall we play a game” )

- Ability to use on London Underground ? not sure if prepay credit cards work so that will be a test for tomorrow.

- Use abroad when we go to Italy with Zero fees (need to check if the ATM operator makes a charge even if Monzo do not `:-)

- Cash abroad, Im think the ability to top up and take cash out the ATM at the MasterCard rate is super close to the rate we get from pre-book currency at MoneyCorp. Again as long as no fees re charged at ATM (see above)

- Purchase something on-line (and see what merchant info is logged)

- If the app can help with my budgeting

- Test out the chat option and see what customer service is like….I wonder where they are based?

- See how a refund unfolds and how it looks transactions

- How many times I have to use by normal card (if Monzo is not accepted)

I will post a follow up article with my Game/test. If you have any questions or tests, feel free to comment below and to keep up to date we now have a subscribe button 😀

Also head over to https://monzo.com/ if your interested in joining up, if I get any golden tickets (Invites) I’ll post them on the comments section.